Most of us know that merchant processing has something to do with running and accepting credit card payments, but what does the process really entail?

THE BASICS

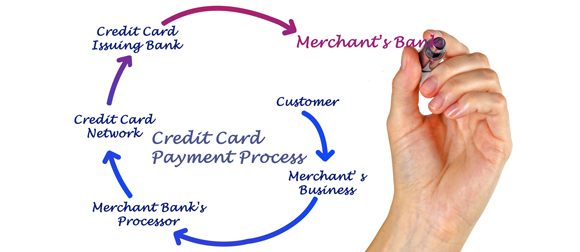

The first thing to understand is that for every credit card transaction, there are essentially four separate entities involved. The first two groups are obvious: you have the customer paying the merchant for goods/services, and the merchant (or business owner) that is receiving the payment. The other two parties involved are the issuing bank (the bank that issued the credit/debit card to the customer) and the acquiring bank (the bank that is providing the merchant with the processing service).

To make things a bit more complicated, often times the acquiring bank is actually made up of several separate parties that work together. You have the actual merchant service provider, or the company whose name you see when you are looking to sign up, and the sales people that work for them, and then you have the company that is actually handling the details of the transaction (the “payment processor”) and providing the merchant with the credit card processing terminal. If you’ve already signed up with a merchant processing partner, you may see that your monthly statement comes from a different company than the one you actually signed up with; that would be the payment processor. There are also underwriters involved in this process, although they may work directly for the merchant service provider or the payment processor. The fact that the acquiring bank is actually several different entities isn’t that essential to know, but it does explain why you may see the name of more than one company on your paperwork/statements when you’re getting signed up with a new merchant processing partner.

So, to summarize, the groups that are involved are:

- Customer

- Merchant

- Issuing Bank (and the associated credit card company: Visa, MasterCard, etc.)

- Acquiring Bank

- Merchant Service Provider

- Payment Processor

- Underwriters

Why are there underwriters involved in the process? Underwriters are the individuals that are responsible for evaluating risk and deciding whether or not a bank or lending company should make a loan to a specific business. The reason they play a role in merchant processing is because when your business accepts credit card payments, you are actually borrowing money.

Here’s the simple explanation: from the bank’s point of view, they are giving you money (the money the consumer is paying for your goods/services) and taking on the potential risk that the consumer disputes the payment or demands a refund (this is known as a chargeback). It would be impractical for you to provide a customer with goods or services and then have to wait until it’s certain that the consumer can no longer return the item or dispute the payment—potentially six months—to be paid. So, the acquiring bank “loans” you the money ahead of time. Of course, by loaning you the money ahead of time, the bank is personally also taking on the risk of a chargeback and of you potentially closing your doors for business and leaving them responsible for paying back any of your complaining customers.

From the acquiring bank’s perspective, there are many factors that increase the risk of the dreaded chargeback, including whether the card was present at the time of the transaction (or whether you’re accepting payments over the phone or online), the industry you are in (some industries are more likely to have items returned or charges disputed than others), the average size of the processed payment (the more expensive your sales are on average, the riskier the bank sees them), whether there’s significant delivery time (the product may be be damaged during transit), and your own personal financial history. In order to assess all these risks, the acquiring bank uses underwriters much in the same way a loan company or bank uses underwriters before deciding to give you a loan.

THE PROCESS

When a customer purchases something from your store on a credit card, the price you charge to the customer’s card will not of course be the same as the money you actually end up with in your bank account. This is because of the fees that are collected by both the issuing bank and the acquiring bank. The issuing bank—the bank that the customer has a credit card from—will charge an interchange fee, and the acquiring bank—the bank that’s providing you with merchant processing—will charge a discount rate. Here’s where it gets complicated though: the fees are going to differ depending on the type of card used, the industry you are in, whether the card was present at the time of transaction, etc. (again, because of the risk of chargeback, as discussed above). Both of these fees are expressed as percentages of the total transaction. Generally, interchange fees are fixed (Visa and MasterCard publish their lists of interchange fees here and here, respectively), although there are still well over one hundred different rates depending on your industry and how the card was processed. Interchange fees are thus not going to change from merchant service provider to merchant service provider. Instead, the fees that change depending on the credit card processing service you’ve signed up with are the discount rates.

In general, there are two ways that your credit card processor will charge discount rates: the interchange plus pricing model or the tiered pricing model. Interchange plus is basically exactly what it sounds like: for every transaction you process, you are charged the interchange fee (of which again, there are over one hundred options depending on your business/transaction scenario) plus an additional fee, and your monthly statements reflect these individual and separate charges. This may make your statements more complicated to read, but it’s also more transparent since it allows you to actually see the interchange fee (what Visa/MasterCard/etc. is charging) and the markup (or discount rate) your processing company is charging as separate items.

With tiered pricing, you don’t see the breakdown between the interchange fee and the discount rate. Instead, you just see one fee charged per transaction. The idea behind tiered pricing is to simplify things for the merchant by grouping the hundred-plus interchange fees into different tiers—such as “Qualified,” “Mid-Qualified,” or “Non-Qualified” transactions—and then just charging the merchant one of those tiered prices for each transaction. While this makes monthly statements a lot simpler to read, it comes at the cost of decreased transparency.

While merchant service processing is very complicated, it’s worth understanding the basic principles and key terms. It’s incredibly difficult to operate a business without accepting credit card payments from customers, and you don’t want to blindly enter into an agreement with a merchant service processing company with no idea of what’s actually going on behind the scenes. Credit card processing is just another important—albeit complex—aspect to the day-to-day realities of running a small business.

Get Funding

Get Funding

Schedule

Schedule Contact Us

Contact Us